The ways of urban transportation have changed numerous times over the past few years. But the biggest change came when booking a taxi became completely hassle-free and turned into a quick tap on a mobile phone. Earlier changes mattered for sure, but they never really changed how most people used transportation every day on a large scale. That’s something ride-hailing did.

Today, popular platforms like Uber and Lyft shape how people move around cities. They have completely influenced how rides are booked, how prices fluctuate, and how many people depend on on-demand travel in their routine lives.

For some users, it’s about finding a reliable ride. For others, it’s about earning a little more as a driver. And for founders, these taxi booking platforms are often studied as examples of scalable marketplace models. In front, if you compare Uber vs Lyft, they look similar in terms of how they both connect riders and drivers through apps. But once you start using them regularly, a lot of differences you will see in reach, pricing, features, and revenue become hard to ignore.

So the real question isn’t just which app is bigger. It’s about which one actually makes sense, and that entirely depends on who’s using it. In this blog, we will discuss how Uber and Lyft differ from each other based on various perspectives, because the experience isn’t the same for everyone.

Uber vs Lyft: An Overview

Uber, a taxi booking app founded in 2009, is operated in 10,500+ various cities across 70+ countries, along with full coverage in the USA. As per the reports, the Uber app has generated USD 19.7 billion in gross bookings, growing 22%, and the delivery number reaches USD 23.3 billion, growing 25%, all for Q3 2025. Together, Uber’s total quarterly bookings stood at roughly USD 43 billion, reflecting its global scale and diversified services.

Lyft, a ride-hailing app launched after Uber in 2012, focuses primarily on North America and serves all the USA states and four Canadian provinces. For Q3 2025, Lyft reported USD 4.8 billion in gross bookings and USD 1.7 billion in revenue and experienced strong growth in rides and active users. Even though Lyft is expanding into the European zones and upgrading to premium services, it remains far smaller in scale than Uber.

As Uber’s presence is wide and global, which gives it deeper operational experience, the real difference becomes clear in the numbers, where its quarterly bookings and revenue far outpace Lyft’s more region-focused model.

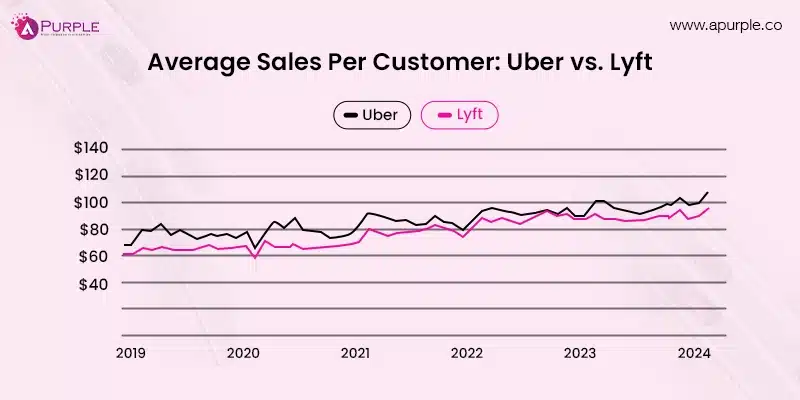

Lyft vs Uber – Average Sales Per Customer

Average sales per customer is one of the metrics that can explain the consistency of users’ spending on ride-hailing platform services and the longevity of these applications among people’s transport options. From the chart data, Uber’s average sales per customer have risen from about USD 75 in 2019 to around USD 100 by 2024, which signifies that customer spending has been rising steadily over the last few years. The trend, which is increasing consistently, confirms that strong customer loyalty is established, and users are gradually and surely becoming willing to pay more for Uber in terms of both per-trip and monthly expenses.

On the other hand, during the same time period, Lyft’s average sales per customer saw a rise from something like USD 65 back in 2019 to approximately USD 90 by the year 2024, reflecting steady growth but at a slower rate when compared with Uber. This trend might imply that Lyft is applying a more conservative growth strategy while it continues nicely to hold its customers’ spending at the same level without the sharper increases seen on Uber.

The stats clearly indicate which service is making more money off each active customer in the long run, a very telling sign of the platform’s ability to monetize over time. Yet, it was mentioned above that revenue generated does not always equate to the success of the entire ride-hailing or taxi application. In fact, there are still a lot of technical, operational, and market-specific factors that play a role in determining how one’s application would perform.

Must-Watch Podcast For You Before Developing a Taxi Application:

But it’s very important to understand that better revenues and sales per customer have much more to do with the well-defined taxi app business model. Let’s explore the difference between the business models of Uber vs. Lyft in the next section.

What’s Uber’s Core Business Model?

Uber’s business model primarily relies on an intermediary platform approach, which allows the company to facilitate different transactions without directly owning any vehicles or hiring any drivers. They run a digital platform that easily connects the passengers and drivers, also utilizing the same infrastructure for food delivery, freight, and other logistics-related services.

The whole operation is based on the separate rider and driver apps, which are supported by a centralized system that is meant to manage pricing, supply balance, fraud detection, and regional performance. The Uber matching method takes into account not only the nearness but also the arrival time, service quality history, supply availability, and driver acceptance behavior as factors for keeping the network stable. Through the app, riders submit the requests, and the drivers then decide to accept or reject them as per the distance, traffic, incentives, and expected payout.

This method became popular and is now widely known as the “UberX-style” on-demand model. However, many startups are trying to replicate this business model for on-demand services to build an app like Uber without realizing how dependent it is on local density and operational scale. Besides, over the years, Uber has increased its revenue through delivery services and long-term mobility partnerships, which is a typical advantage of being scaled up to a massive size.

What’s Lyft’s Core Business Model?

At a high level, Uber’s business model and Lyft’s business model operate in very similar ways. Just as Uber does, Lyft also serves as a mediator that offers platform service to both riders and independent drivers.

In its early years, Lyft set itself apart from others with its shared rides as the main focus and community-oriented approach as the main branding. But eventually, Lyft changed its strategy and went for shorter, more frequent urban trips, thus increasing both driver utilization and unit economics.

Currently, customers (riders) can choose and book Economy, Premium, and XL ride options straight through the Lyft app. Just like Uber, Lyft is completely operated through a mobile app. Drivers who get the ride requests instantly can accept or deny them according to their availability and potential earnings.

If both platforms use a similar model, the next question is whether pricing is also similar?

The answer is “No”!

Lyft vs. Uber: Is There a Price Difference?

There are noticeable pricing differences between the Uber and Lyft taxi booking applications when looking at particular cities, ride types, and times. The latest research on more than 2200 rides shows that the price gap between Uber and Lyft was on average 14% (~$3.50 to $4.15) for the same trips, and neither of them was always cheaper. As per Q3 2025 data reports, Uber rides average $13.01 gross per ride, and Lyft rides average $11.95, with premium classes like Comfort at $21.30 (Uber) and $20.48 (Lyft).

Dynamic pricing is common to both ride-hailing applications; they have base rates, per-mile (~$1-2 by city), per-minute fees, and surges. For instance, Lyft NYC charges $1.66/mile, with no uniform base across cities. A 7.2% YoY price increase pushed the median ride up to ~$15.99, and suburban prices were affected by demand. You can use the official estimators for real-time quotes.

Even though Uber is usually seen as the more expensive option, there are scenarios where Lyft can be priced higher in some urban markets during peak demand. In general, though, Lyft gives slightly lower base fares, but the difference is frequently insignificant. Uber’s larger driver network often ensures better availability during off-peak hours, so people are willing to pay a little more for that convenience.

Despite price not being the only factor determining the leadership, market reach is the factor providing the most straightforward understanding.

What Is The Market Share of Uber and Lyft?

When comparing Lyft’s market share to Uber’s, we can see that Uber’s share is higher and it is continuously in the leading position, even in 2026. The Uber app secures 74% to 76% of the USA rideshare market, and comparatively, Lyft just holds approximately 24% to 26% of the USA rideshare market.

A prominent reason behind Uber’s consistent top position is its diversification, which enables it to mitigate ride-margin pressure through delivery and local commerce growth. Uber’s revenue mix combines a large share of mobility and delivery together, which reduces its overall dependency on ride pricing alone.

Lyft is still concentrating on ridesharing only, and it is cautiously moving into healthcare and enterprise transportation rather than a wide range of consumer services. The difference becomes more apparent when comparing the variety of services that each platform is offering.

What Types of Services Do Uber and Lyft Provide?

When you compare the types of services offered by Uber vs Lyft, Uber provides a larger range of services than Lyft.

| Service Category | Uber | Lyft |

|---|---|---|

| Standard Ride Booking | UberX: It’s an everyday car with a limit of 4 passengers; the most affordable solo option. | Lyft Standard: Standard cars with a capacity of 4 passengers; straightforward and reliable option. |

| Large Vehicle Service | UberXL: Provides SUVs or minivans with a seating limit of 6 passengers. Also gives options for premium interiors. | Lyft XL: A Spacious vehicle for a group of 6 passengers; XXL upgradation available in selected areas. |

| Comfort Rides | Uber Comfort: New vehicles with extra legspace and top-rated drivers. | Extra Comfort: Serves roomier cars with highly rated drivers and multiple amenities. |

| Premium Rides | Uber Black: Offers professional drivers with great experiences in luxury sedans. | Lyft Black: Upscale sedans with leather seats and premium service availability. |

| Luxury Rides | Uber Lux: High-end vehicle choices for elevated journey experiences (available in key markets). | Lyft Black SUV: Luxury SUV options for up to 6 passengers, focusing on comfort as well as style. |

| Car Pooling | UberX Share: Route-matched shared rides availability, now including Route Share for fixed commuter corridors with a discount of 50% off. | Shared Rides: Pooled trips for customers with others on similar routes; this can include Wait & Save for budget shared options. |

| Food Delivery | Uber Eats: On-demand meals, groceries, and pharmacy delivery services in minutes from thousands of partners. | N/A |

| Freight Management/Logistics | Uber Freight: Full truckload and logistics services for businesses to ensure seamless transportation. | N/A |

| Scooter Rentals | Uber Green: Electric bikes and scooter services integrated for short and eco-friendly trips in 100+ cities. | Lyft Scooters and Bikes: Gives dockless e-scooters and bikes for quick urban trips, with a Community Pass discount. |

| Healthcare Transportation | Uber Health: Non-emergency rides, plus grocery/OTC delivery for patients. Additionally, it now covers flex cards and home health coordination. | Lyft Healthcare: Provides appointment rides with assisted door-to-door support, which is expanded to 21 states. |

This comparison of different types of ride services highlights how Uber prioritizes scaling while the Lyft app prioritizes its core focus. But for drivers, how the app compensates and provides consistency matters more than the service variety. Let’s explore it in the following section.

How Are Drivers Compensated and What Benefits Do They Receive?

When it comes to drivers, it is crucial to comprehend the difference in compensation between Uber and Lyft for planning long-term earnings. Understanding this will clarify for drivers the better platform to choose for driving according to their circumstances of availability, cost, and driving habits.

- In 2025, Uber drivers are making on average USD 20 to 25 per hour in metropolitan cities such as New York or Los Angeles. In California, it’s approximately USD 21.90 an hour. A full-time driver who works 40+ hours per week might end up with a paycheck of USD 600 to 800 every week, which adds up to USD 31,000 to 41,000 a year, with some drivers making USD 1,000 per week in the high-demand areas during peak times.

- Lyft drivers’ hourly rates are around USD 21 to 23, similar to Uber, but with fluctuations. Some reports even claim that in some of the markets the rate has gone up to USD 29. The company ensures that a driver gets at least 70% of the rider fares after deducting the fee. Full-time earnings remain competitive with Uber’s, around USD 30,000 to 40,000.

But what about other perks and benefits?

Here is a comprehensive comparison of drivers’ different perks with Uber vs. Lyft!

| Perks & Benefits for Drivers | Uber | Lyft |

|---|---|---|

| Flexibility | Drivers can set their working schedules and switch between rides/deliveries. | Drivers can set their working hours and locations for busy zones. |

| Bonus and Incentives | Opportunity to receive promotions during peak hours, Uber Pro rewards. | Drivers can have turbo bonuses (10-40%), ride challenges, and reward points for tiers. |

| Cashback on Gas | For some markets, it can be received via Uber Pro. | Based on rides, drivers get cashback on fuel. |

| Access to Wellness Perks | Limited, focus on EV health/safety tools. | Debit card for wellness perks like gym discounts. |

| Community Stories | Driver hubs in the application for important tips/updates. | Driver blog option for stories and local events. |

How Do Uber vs. Lyft Compare in User Experience?

This comparison analyzes Uber vs. Lyft on various factors, such as price, compensation, and market share. However, it will still be incomplete without considering the user experience of both ride-sharing apps.

The basic ride-booking experiences of Uber and Lyft are still very similar, but both platforms have made their apps even better by supporting different strategic priorities. Uber is still integrating various services like rides, delivery of food, and local businesses into a single application, making it more convenient for frequent users.

On the other hand, Lyft is adopting a less complicated and more focused interface, which results in faster bookings and reduced friction with decision-making. Still using rider-driver identification tools to enhance pickup accuracy, the two platforms eventually came to a point where these features are considered standard expectations rather than standout differentiators.

The dedicated rider app also offers live ride tracking, instant communication with drivers, and fare estimation features. These may sound like basic functionality, but even their clones involve a thorough analysis of the Uber app development cost. The price may vary and can be higher depending on the complexity level of integrated features.

A user who picks one of the two ride-sharing apps just for the sake of the app experience may feel that there is a difficult choice. But if you weigh all the factors mentioned above, like price, service type, app experience, and market share, then the decision is made a bit easier!

What Are the Future Trends and Innovations for Uber and Lyft?

By the year 2026, ride-sharing apps Uber and Lyft will have boosted their pace of innovations, especially in the fields of autonomous vehicles and eco-friendly practices.

Uber has revealed its plans to introduce driverless vehicle fleets in the San Francisco Bay Area by the year 2026, by partnering with leading autonomous vehicle companies. Its strategy of a super app has advanced significantly; now it’s integrating ride-hailing, food delivery, package shipping, and public transit ticketing operations into one platform. Moreover, Uber has broadened its eco-friendly measures, with the USD 800 million Green Future program that is facilitating the changeover of drivers to electric vehicles and the assurance of achieving global zero-emission status by 2040.

On the other hand, Lyft is setting up driverless cars for the first time in 2026 and working toward its 100% electric vehicle goal by 2030. Lyft’s Green Mode has increased its reach to 22 cities and 40 airports, which enables passengers to virtually book an electric or hybrid ride. Even though Lyft opted for the focused strategy over a super app, it has still outlined its partnerships in healthcare transportation and expanded its bike and scooter sharing services in the major urban centers. Thus, making it easier for people to get around.

Uber vs. Lyft: It’s Verdict Time!

In 2026, Uber still holds the upper hand over Lyft in terms of competition, though the gap has narrowed in certain aspects. When it comes to comparing operational capabilities, global reach, service diversity, and market share, Uber stands out without any doubt. Its market share in the US is about 55% while that of Lyft is 31%, so Uber’s leading status continues to be backed by its ever-growing worldwide presence in 70 countries and 15,000 cities. Besides, Uber’s monthly customer spending average of USD 115 also surpasses Lyft’s USD 98, thus intensifying the revenue gap in its favor.

However, the selection of ride-hailing apps is still influenced by numerous factors such as the user’s location, unique requirements, and personal likes and dislikes. The two compete in different areas of the country, but for a user, the best option depends on the services available in their region. The decision will vary if Uber is superior in one aspect and Lyft in another. Uber is the preferred option for drivers, but it really depends on how many incentives each ride-hailing app makes available in different places.

On the other hand, if you are a business intending to do taxi app development like Uber or Lyft, then you are in need of a reliable app development company that has expertise in the field. Get in touch with us right away to discover more about on-demand development services.

FAQs

Uber and Lyft ride-hailing apps differ mainly in terms of drivers’ pay structure, incentives, and flexibility. Uber provides higher trip volume and great earning opportunities by accessing busy markets, while Lyft often provides simpler incentives and a more driver-friendly app experience. Drivers mostly choose an app based on local demand and personal earning goals, as the pay rates, bonuses, surge pricing, and driver support can vary city to city.

The tipping period for Lyft is 72 hours, while Uber accepts cash tips or tipping before the trip ends. Uber has more cities in the world, while Lyft’s trip receipts are clearer.

Yes, as long as they meet city requirements for insurance, background checks, and minimum ages.