If you have ever thought, after seeing apps such as Revolut or Cash App, “Why can’t my startup create a finance product, something like that?”, then you are already thinking in the right way! The financial sector, undergoing major digital transformation and fintech app development, is the centre of it.

But from where to start? How to build a fintech app that fulfills the users’ needs? What does it take to develop a future-ready digital wallet app or a next-generation finance management software app that can allow competition in a competitive marketplace? More importantly, how much money does it take to develop software for fintech, and what key factors should you consider before hiring your team?

In this guide, we will discuss how to develop a fintech app from scratch, from must-have features and regulatory compliance to real-world examples of startups that have scaled faster and smarter.

What is Fintech App Development?

Fintech application development is the process of designing and developing mobile and web financial applications that provide financial services such as mobile banking, digital payments, and investment tracking, accessible and convenient.

These fintech apps aim to make financial tasks more secure, efficient, and accessible for users by simplifying transactions and using technologies like AI, Blockchain, Cloud Computing, and other similar technologies.

What are the Different Types of Fintech Apps?

Below, we have mentioned some of the different types of fintech apps:

1. Mobile Banking Apps

Mobile banking apps have transformed how people manage their finances from their smartphones. Mobile banking apps offer instant access to accounts, fund transfers, bill payments, and a range of other services.

These fintech apps offer efficient, convenient, and accessible financial services to users in one place.

A popular example of a mobile banking app is Revolut, which sets new benchmarks for user-friendly banking.

2. Payment and Money Transfer Apps

Payment and money transfer apps enable users to send and receive money instantly, pay bills, and manage transactions securely anytime, anywhere.

They often integrate with bank accounts, cards, and digital wallets, simplifying daily financial activities.

The popular examples for payment and money transfer apps include PayPal and Venmo.

3. Personal Finance and Budgeting Apps

These apps are designed to help individuals track expenses and create a budget. By syncing with bank accounts, they categorise spending and suggest saving options. These types of apps offer financial insights and empower users to make informed decisions.

Examples include YNAB (You Need A Budget) and PocketGuard.

4. Investment and Trading Apps

Investment and trading apps provide users with the tools to buy and sell stocks, ETFs, or other similar assets. They offer real-time market data, portfolio management, and educational resources to help both beginners and experienced traders.

Some of the popular example for investment and trading apps includes Robinhood.

5. Crowdfunding and Fundraising Apps

These applications raise money for various causes, facilitating crowdfunding for personal, social, or entrepreneurial projects.

Crowdfunding apps gather financial support from many individuals to fund projects or businesses. In contrast, fundraising apps focus on non-profit organizations, charities, educational institutions, or personal causes like medical expenses and community projects.

Some of the popular example of crowdfunding and fundraising app is GoFoundMe.

6. Neobanks

Neobanks are fully digital banks offering banking services without physical branches. They provide seamless mobile experiences, lower fees, real-time notifications, and features like instant transfers and savings automation.

Noebanks also focuses on personalization, that is, helping users manage budgets, track expenses, and access financial insights. They are transforming how people interact with banking services with their speed and transparency.

The popular example for neobanks are Chime and Varo.

Must Watch: How Neobanks are reshaping the financial landscape with cutting-edge digital banking solutions.

7. Blockchain and Cryptocurrency Apps

Blockchain and cryptocurrency apps facilitate crypto trading, digital wallets, and decentralized finance (DeFi) operations. They focus on secure, transparent, and fast transactions while enabling users to invest and manage crypto assets.

These types of apps also include real-time portfolio tracking, multi-currency support, and security through encryption and two-factor authentication.

Examples: Coinbase and MetaMask

8. Lending Apps

Lending apps connect borrowers with lenders for personal, business, or peer-to-peer loans. These types of apps often automate credit checks, loan approvals, and repayments, making borrowing faster and more accessible.

Through these apps, users can track loan status, manage EMIs, and receive instant distributions, all within the app.

Popular examples for this type are Upstart and LendingClub. These apps demonstrate how lending apps are accessible to a wider audience.

9. Insurtech Apps

Insurtech apps streamline insurance services such as policy purchases, claims, and risk assessment. By digitizing these processes, these types of apps make insurance more convenient, transparent, and customer-friendly.

These apps use technologies like AI, machine learning, and data analytics to detect fraud, process claims quickly, and reduce human errors.

Popular examples include Lemonade and WeFox, these apps are redefining trust and efficiency in the global insurance market.

10. RegTech Apps

RegTech apps help financial institutions comply with complex regulations efficiently. They automate compliance monitoring, risk management, and reporting, reducing manual errors and ensuring businesses meet legal standards.

RegTech apps can identify suspicious activities in real time, ensure compliance with global standards such as KYV, GDPR, PCI DSS, and others, and generate reports effortlessly.

A popular example of this type is ComplyAdvantage.

What Steps are Involved in Fintech App Development?

Now that you’re familiar with the types of fintech apps, you might be wondering about the steps involved in the fintech app development process. To help you understand this better, we have outlined the steps to create a fintech app below.

1. Conduct Market Research

The first step in fintech app development process is to conduct market research and identify the niche within the industry. While conducting the research try to understand

- What are the customer pain points?

- What they wants from a fintech app?

- What are the areas your competitors are not addressing?

By finding the answers to the above questions, you can determine what features and services your app will offer to meet your target audience’s needs and effectively create an app that addresses a specific market gap.

2. Security and Legal Compliance

The second and crucial step in the fintech app development process is to deal with security and legal compliance. As you are dealing with sensitive financial data, your app must comply with regulations like KYC, AML, PCI DSS, and other similar regulations.

Apart from these, there are so many other security measures, like biometric authentication, data encryption, and secure cloud infrastructure. Adding these to your fintech app will help build user trust and prevent cyber threats.

For the integration of security and compliance in your fintech app, it’s a wise idea to connect with a startup consulting services provider. They will ensure your app meets all the regulatory requirements.

3. Build Your Team or Hire a Development Partner

As you have defined your target niche and compliance, the next step in the development process is to bring together the right tech team. There are two options: either you can build an in-house team or collaborate with an experienced fintech app development company.

For startups, it is good to partner with a development team that will save time, cost, and effort. Look for a team who are expert in creating a secure architecture, financial integration, and others.

Look for a team who have skilled designers, developers, and testers under one roof. A reliable partner will guide you through every stage and ensure your product meets industry standards.

4. Design Intuitive UI/UX

In fintech apps, design plays a very important role in building trust in users. Your app interface should be easy to navigate, transparent, and secure, as users share sensitive financial data. A simple and clean design will help users understand complex financial information effortlessly, while an intuitive flow keeps them engaged.

While designing the app, focus on creating a simple login/signup process, clear dashboards, and an easily accessible support section. Prioritize speed and clarity to ensure that every user, whether tech-savvy or not, feels comfortable while using the app.

5. Build an MVP

Before investing in a fully featured application, it is smart to launch an MVP (Minimum Viable Product) at the start. It is a simplified version of your fintech app that includes only the core features that your users need. This approach allows you to validate your app idea, gather user feedback, and validate the market demand without spending a large budget.

For example, initially, you added basic features like registration/login, account management, payment integration, and others. Once the MVP gains traction and you understand what your users want, you can add advanced features and expand the MVP into a full-fledged product.

MVP app development for fintech also comes up with so many other advantages, like it helps attract early investors, identify usability issues, and reduce time to market.

For fintech startups, this strategy minimizes risks and accelerates product launch. Collaborating with an MVP development services provider can significantly assist in the development process.

6. Deploy and Launch

The last and final step in the fintech app development process is to test, deploy, and launch your app.

Testing helps you find and fix any issues related to performance, security, or user experience. It is important to ensure that every feature works smoothly and safely.

Once testing is done, you can deploy your app on the App Store or Google Play Store. Ensure all the compliance and security checks are completed before launching it for users.

Regular maintenance helps your app run well. Update it frequently, fix bugs, and add new features based on user feedback. This will help your app stay reliable, secure, and competitive in the fintech market.

What are the Must-Have Features & Tech Stack Used in a Fintech App?

When planning a fintech app, it is important to integrate features that ensure convenience, security, and a smooth experience for users and admins. Below, we have listed the must-have features in a fintech app:

User Side Features:

| Features | Description |

|---|---|

| Secure sign-up and login | The login and signup process should include multi-factor authentication, biometric login, and encryption to ensure the security of user data. |

| Personal dashboard | Must be a clean dashboard that gives users a proper overview of their transactions, spending patterns, and others. |

| Instant payment and transfer | This feature will help users with smooth money transfers, real-time transaction updates, and bill payments. |

| Budgeting & analytics tools | Through this feature, users can gain smart insights, track expenses, and get saving recommendations. |

| Notifications & alerts | It is a very important feature for users, as it gives them updates about payments, offers, and other activities. |

| Customer support & Chatbots | Offers 24/7 support through in-app chatbots and customer support channels to resolve problems and increase user satisfaction. |

Admin Side Features:

| Features | Description |

|---|---|

| User management system | This provides admins access to and manage user profiles, KYC verification, and account control settings. |

| Data analytics dashboard | This feature offers real-time insights into user activity and financial performance through data visualization and reporting tools. |

| Fraud detection & risk management | Through AI-powered monitoring tools, admins can identify unusual transactions, detect potential fraud, and ensure security. |

| Content management | This enables admins to manage in-app promotions, and push notifications to enhance user engagement. |

| Compliance management | Ensure compliance with key financial regulations like KYC, AML, and PCI DSS through automated compliance checks and other tools. |

| Reports & audit trails | Maintaining detailed logs of all user activities and transactions to promote transparency and strengthen regulatory compliance. |

By integrating these features, you can build a secure, scalable, and user-centric fintech application that satisfies the users and also gives admins control and visibility over operations.

What Tech Stack is Used in Fintech App Development?

The fintech industry handles sensitive financial data, so using reliable, secure technologies is important to build user trust and meet compliance standards. Evaluating different mobile app development frameworks is essential to developing a secure, scalable fintech app.

| Layers | Technologies |

|---|---|

| Frontend | React, Angular, React Native, Flutter, Vue.js, Swift, Kotlin |

| Backend | Node.js, Python, Java, Django, Spring Boot, Ruby on Rails |

| Database | PostgreSQL, MySQL, MongoDB, Cassandra, Firebase |

| Cloud & Hosting Platforms | AWS, Google Cloud, Microsoft Azure |

| Security & Compliance | OAuth 2.0, SSL, AES Encryption, PCI DSS, GDPR, KYC, AML standards |

| Other Supporting Technologies (Blockchain & AI & ML) | Ethereum, Hyperledger, TensorFlow, Scikit-learn |

The tech stack mentioned in the above table will help you in building a secure and scalable fintech app. When you hire developers, make sure they are skilled in these technologies to deliver an app that is reliable and compliant.

What is the Cost to Develop a Fintech App for Startups?

A few questions may occur in your mind while planning a fintech app:

- How much does it cost to develop a full-featured fintech app?

- What is mvp development cost for a fintech app?

Well, the fintech app development cost depends on the type of app you want to build. Below is the estimated breakdown of the cost with the expected timeline.

| App Type | MVP | Basic App | Complex App |

|---|---|---|---|

| Timeline: | 2 to 4 months | 3 to 6 months | 9 to 12+ months |

| Estimated Cost | USD 12,000 to USD 18,000+ | USD 18,000 to USD 30,000+ | USD 30,000 to USD 80,000+ |

Note: The above is an estimated fintech app development cost, it may vary depending on the app features, tech stack used, and other requirements.

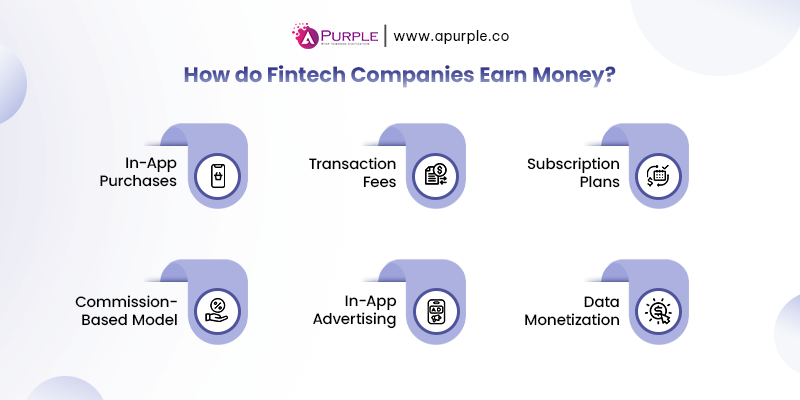

How do Fintech Companies Earn Money?

As you have gone through the complete process for fintech app development, now it’s time to understand the different monetization models of any fintech app.

Nowadays, fintech companies use a combination of monetization strategies depending on their niche, audience, and serving offers. Let’s explore the different monetization models for fintech apps.

1. In-App Purchases

This is among the most popular monetization models that allows users to pay for additional features or premium content within the app. By offering valuable add-ons, you can attract users to upgrade, and this will increase your revenue.

2. Transaction Fees

One of the most common fintech monetization models, especially for payment and money transfer apps. Fintech platforms make money by charging a small percentage or sometimes a fixed fee on every transaction processed through the application.

3. Subscription Plans

Like other apps, fintech apps also use a subscription-based monetization model. Under this model, the app offers free basic services and premium plans with tools like analytics, financial advisory, and others. This approach creates a recurring revenue stream.

4. Commission-Based Model

The commission-based model is commonly used by investment, lending, and trading apps. These apps often earn money through commissions on successful trades, loan disbursements, or fund management activities.

5. In-App Advertising

This is a common monetization strategy for fintech apps, it involves displaying ads within the app’s interface. This might not generate as much revenue, but it can be a valuable source of income, especially during the initial stages of your app’s growth.

6. Data Monetization

Another monetization strategy you can implement in your fintech app involves collecting valuable user data, which can then be monetized through various channels. With proper user consent and compliance, you can sell anonymized data to third-party companies for market insights or use it for strategic partnerships with other businesses.

By integrating the right monetization model during the fintech app development phase, startups can ensure a balance between user value and business profitability.

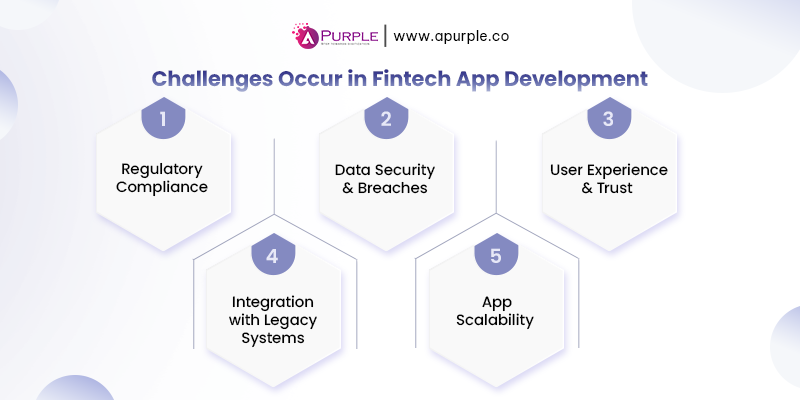

What Challenges Occur While Developing a Fintech App?

The fintech app development comes with a unique set of challenges that can harm your app. Understanding the fintech app development challenges and how to overcome them at an early stage will help you avoid the common startup mistakes and ensure a smoother development process.

1. Regulatory Compliance

One of the biggest challenges in app development for fintech is managing the complex financial regulations like KYC, AML, GDPR, and PCI DSS. Many startups and businesses make the mistake of overlooking compliance in the early stage, which leads to delays or penalties later.

To overcome this challenge, it is advised to collaborate with an expert mobile app development company from the initial stage. These legal experts will provide advice on integrating automated KYC/AML verification systems into your app to ensure compliance.

2. Data Security and Breaches

Ensuring security is a top concern in fintech app development, as it handles highly sensitive data. According to the SecurityScorecard’s 2025 report, 18.4% of the top fintech companies had publicly reported data breaches. It has been seen that startups often underestimate the importance of robust security architecture.

The solution to this lies in implementing advanced encryption, multi-factor authentication, biometric login, and security audits on a regular basis.

3. User Experience & Trust

Another challenge you can face is a complicated onboarding process, or a complex interface can drive users away. Users expect the app to be simple, fast, and easy to navigate. At the same time, as mentioned in the above point, securing user data is very important.

This challenge can be overcome by focusing on intuitive app design, clear financial data visualization, and simplified onboarding processes. You can also conduct usability testing to ensure your fintech app feels seamless from the first interaction.

4. Integration with Legacy Systems

Fintech apps often depend on integrating with banks, payment gateways, and other third-party APIs. However, issues with compatibility and performance may delay the launch of the application.

To address this, choose reliable APIs and allocate adequate testing time to ensure smooth integration during the custom fintech app development process.

5. App Scalability

One of the challenges that may arise when developing a fintech app is scalability. The app’s ability to scale depends on the technology stack you select. If the design and development are not executed correctly, the app may slow down or crash as the user base grows.

To prevent your app from this, choose scalable cloud platforms, use a microservices architecture, and conduct QA and testing. Planning for scalability during the initial stage ensures smooth performance.

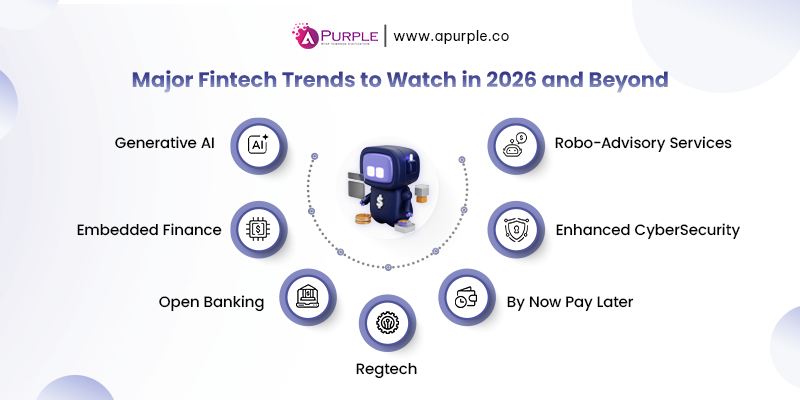

What are the Major Fintech Trends to Watch in 2026 and Beyond?

The fintech industry is evolving faster, driven by advancements in technology. As the technology is evolving, it is important to keep an eye on the major fintech trends that will shape the future of digital finance. Here are some of the most significant innovations to look out for:

1. Generative AI

As we have seen from the past few years, AI plays a crucial role in different industries. Following that, AI will continue to redefine fintech by offering personalized financial insights, fraud detection, and automated customer support.

Generative AI will improve chatbots, investment advice, and credit risk analysis, allowing companies to make data-driven decisions more quickly.

2. Embedded Finance

The finance services will increasingly be integrated into the non-financial platforms like retail, healthcare, travel, or similar apps. This trend will allow businesses to offer seamless payment, insurance, or other similar services within their ecosystem, making financial transactions more convenient.

3. Open Banking

The use of open banking is redefining how users interact with their finances. Secure APIs are becoming the backbone of fintech innovation. Integrating APIs allows apps to merge data from different financial platforms, allowing users to manage their accounts, payments, and investments in one place.

4. Regtech

The global finance regulations are becoming more complex, and RegTech (Regulatory Technology) is emerging as a key trend in fintech app development.

RegTech helps financial institutions and startups automate compliance processes, monitor transactions, and manage risks. By integrating this, startups and businesses can ensure transparency, reduce human error, and stay compliant.

5. By Now Pay Later (BNPL)

The Buy Now, Pay Later trend continues to reshape consumer finance by allowing users to split purchases into smaller and manageable installments. For fintech startups and businesses, this model offers new opportunities to attract consumers seeking flexibility and convenience.

6. Enhanced CyberSecurity

As cyber threats are increasing, security remains a top priority in fintech apps. Developers are adopting advanced technologies such as threat detection, quantum-resistant encryption, and multi-factor authentication to safeguard sensitive financial data. This increased focus on digital security builds stronger user trust and ensures long-term app reliability.

7. Robo-Advisory Services

Robo-advisors are transforming investment management by offering automated, data-driven financial advice at a fraction of traditional costs. These AI-powered platforms analyze user goals and risk tolerance to provide personalized portfolio recommendations. As digital investing becomes mainstream, robo-advisory services will play a crucial role in making smart investing accessible to all.

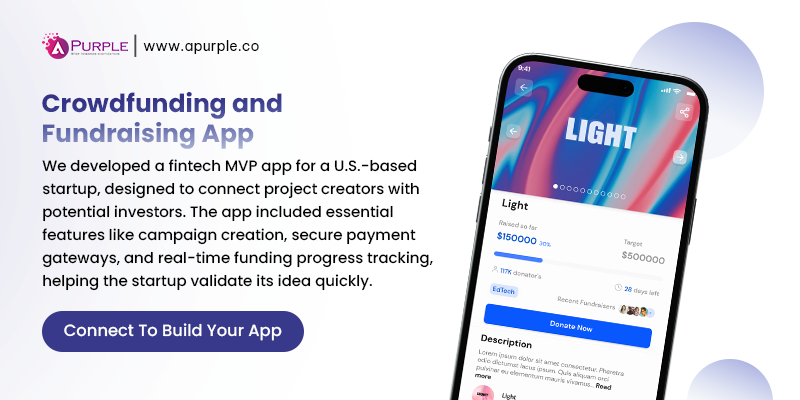

Fintech Apps Developed by aPurple

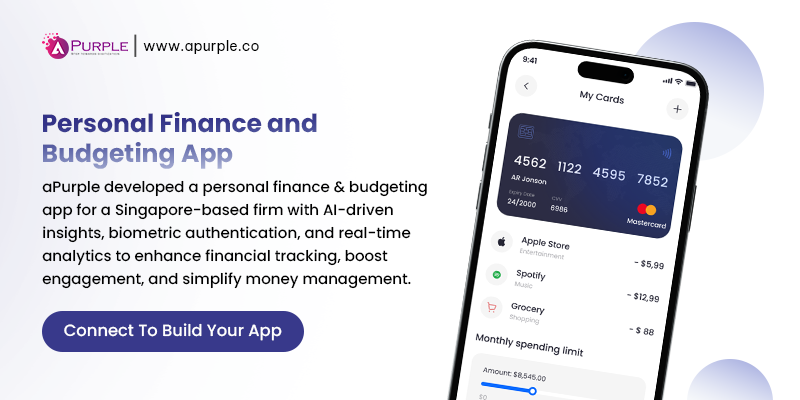

At aPurple, we’ve partnered with global startups and businesses from the US, Singapore, and the UAE to build and upgrade fintech solutions. In the US, we have developed an MVP for a Crowdfunding and Fundraising app, for our Singapore-based client, we have built an advanced, feature-rich Personal Finance and budgeting app, and for a UAE-based firm, we have enhanced their existing Payment and Money Transfer App.

Below, we have mentioned the detailed study of these, showcasing how our team turned ideas into successful, scalable fintech apps.

Conclusion

Fintech app development is changing the way businesses and individuals manage money, offering faster and more convenient financial services. Whether it’s payments, lending, personal finance, or anything else, a well-designed fintech app can help startups and small businesses reach their goals while providing an exceptional user experience.

However, building a successful fintech app requires the right strategy, secure technology, and compliance. This is where partnering with one of the top fintech app development companies, like aPurple, will help you.

At aPurple, we specialize in helping startups and growing businesses to develop their dream application. From planning to successful launch and post-launch support, our team ensures your fintech app meets both user expectations and industry standards.

Frequently Asked Questions

- Regulatory Compliance

- Data Security and Privacy

- User Trust

- Integration with Legacy Systems

- Scalability

- User Experience

- Keeping pace with technology

- In-app purchase

- Transaction fees

- Subscriptions plans

- Commission-based model

- In-app advertising

- Data monetization